Market Trends

The Specialty Ingredients sector is in a time of evolutionary change with new markets opening up, primarily driven by an improved standard of life and growing middle classes in developing markets. There is also an increased demand for personalized health and a push towards environmentally friendly and sustainable products. All these opportunities come with challenges, as the sector faces increased complexity in global regulatory requirements and raw material shortages (with associated price volatility). There is also increased competition with the rapid rise of Chinese chemical producers and the new and innovative market entrants challenging established players.

We are well positioned to overcome these challenges and capitalize on existing opportunities to drive growth and accommodate increased demand.

Our Offerings

In Lonza Specialty Ingredients (LSI), we are focused on further strengthening our market leadership in microbial control solutions to protect our environment and ourselves from harmful microbes. Our businesses deliver customer-focused, innovative and smart solutions for a wide range of consumer and industrial markets, as well as wood applications and agricultural offerings along a common microbial control solutions platform.

21

Manufacturing Sites

>5,300

Customers Worldwide

43

Fields of Application

A key challenge for our customers is the increasingly complex and evolving regulatory landscape. We can help them by applying our deep understanding of both current and future regulations to enable them to achieve performance and regulatory compliance.

We also provide solutions for composite materials and processing additives for high performance industries, performance chemicals and intermediates as well as custom development and manufacturing.

In 2019, the LSI segment comprised the following offerings:

In 2019, we announced the decision to carve-out the LSI segment, with the intention of operating independently whilst remaining part of the Lonza Group. This will allow us to grow and strengthen our leading role in the microbial control solution market, as well as operate more efficiently. We expect to complete the process by mid-2020.

Personal Perspective

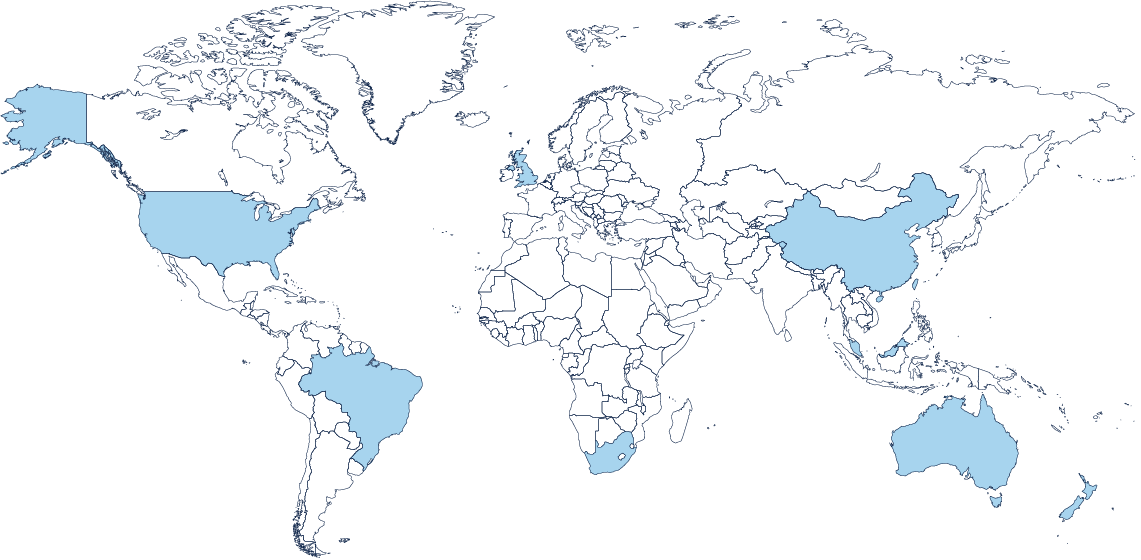

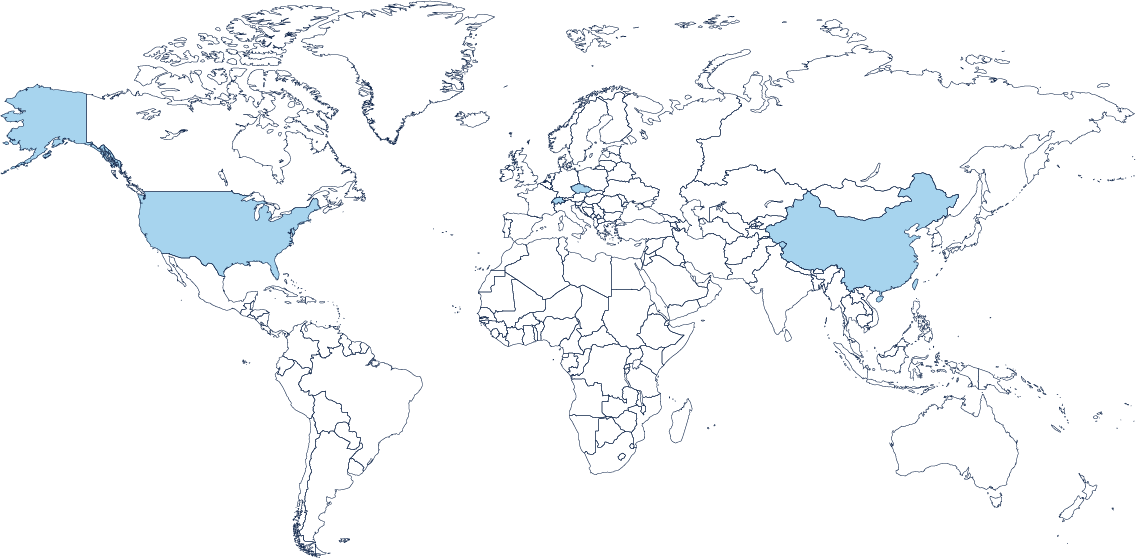

Our Global Footprint

With representations in 28 countries across 5 continents and 2,504 employees, we take care of our customers and their global, regional or local requirements.

Huddersfield, UK

Auckland, New Zealand

New Plymouth, New Zealand

Trentham, Australia

Penang, Malaysia

Suzhou, China

Port Shepstone, South Africa

Salto, Brasil

Rochester, USA

Williamsport, USA

Mapleton, USA

Conley, USA

Kalama, USA

Valparaiso, USA

Visp, Switzerland

Kouřim, Czech Republic

Nansha, China

Nanjing, China

Lake Charles, USA

Financial Highlights

Lonza Specialty Ingredients (LSI) has experienced headwinds during 2019. Sales declined 3.2%, resulting in CHF 1.7 billion revenues for the segment. Pricing initiatives, operational improvements and cost control measures resulted in a CORE EBITDA of CHF 302 million and a solid 17.8% CORE EBITDA margin. We will continue to focus on driving recovery for our business, delivering the carve-out and developing a new market-oriented and efficient organization. Over the course of 2019, we have worked to develop the structure of our business to reflect more accurately the underlying technology platforms. The business is now set up with a leading portfolio of Microbial Control Solutions (MCS), supported by a division of dedicated Specialty Chemicals Services (SCS).

|

Million CHF |

2019 |

Change in % |

2018 Restated1 |

||

|---|---|---|---|---|---|

|

Sales |

1,693 |

(3.2) |

1,749 |

||

|

CORE EBITDA |

302 |

(0.3) |

303 |

||

|

Margin in % |

17.8 |

|

17.3 |

||

|

CORE EBITDA excl. IFRS 16 |

297 |

(2.0) |

303 |

||

|

Margin in % |

17.5 |

|

17.3 |

||

|

CORE result from operating activities (EBIT) |

223 |

(1.8) |

227 |

||

|

Margin in % |

13.2 |

|

13.0 |

||

|

CORE result from operating activities (EBIT) excl. IFRS 16 |

222 |

(2.2) |

227 |

||

|

Margin in % |

13.1 |

|

13.0 |

||

|

|||||

Sales

Million CHF

CORE EBITDA

Million CHF

CORE EBITDA Margin

In %

1 Reported pro-forma full-year 2017 financial results include Capsugel full-year 2017 financial results

2 Restated to reflect the 2019 realignment of Lonza’s segments into Pharma Biotech & Nutrition and Specialty Ingredients